Menu

Modal Title

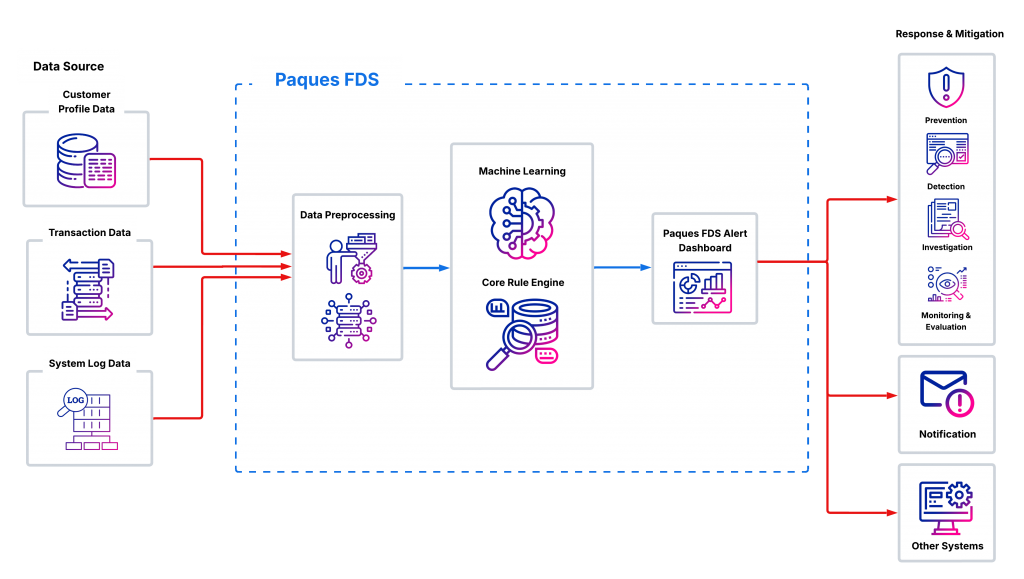

Your Adaptive Shield Against Complex Fraud Patterns

The Fraud Detection System or FDS (Now officially known as Nethra) is designed with adaptive capabilities, as it is built on top of the Paques Platform. This architecture ensures flexibility in addressing the increasing complexity and variability of emerging fraud patterns, enabling alignment with established legal frameworks and regulatory compliance requirements, including those mandated by Indonesia’s Financial Services Authority (OJK).

Preventing fraud does not end just by stopping it by the doorstop. It needs a careful, thorough methods to control and monitor fraud completely as to prevent the next similar fraud from happening. Paques Fraud Detection System (Nethra) implements methodical anti-fraud strategies by utilizing data trends to preemptively anticipate suspicious activities holistically, based on the 4 Pillars of Anti-Fraud Tools:

Prevention

Covers the analysis on vulnerability assessment and to assess possible fraud risks.

Detection

Focuses on uncovering, identifying, and finding out fraud incidents.

Investigation

Indicates the further examination whether a case is fraud related or a false positive.

Monitoring & Evaluation

Designate the monitoring follow-up actions after a fraud incident and to perform evaluation using available fraud profiling.

Paques Fraud Detection System Flow Sheet

Responds quickly to evolving fraud tactics and regulatory frameworks, reducing operational risk while ensuring continued compliance.

Analyzes geographic patterns to spot location-based fraud anomalies and reduce false positives.

Leverages behavioral analytics and machine learning to recommend dynamic rules, enabling analysts to stay ahead of fraud trends.

Provides a unified view across digital, mobile, branch, and other channels to detect suspicious patterns in real time.

Advanced risk scoring and profiling help prioritize threats and accelerate response with confidence.

Built to grow and adapt with your institution’s evolving needs and threat landscape.

Built on the Paques Platform, which features a modular architecture and a rich set of toolsets, the system offers adaptive capabilities—enabling high customization flexibility to meet institution-specific needs and align with regulatory compliance requirements, including those mandated by Indonesia’s Financial Service Authority (OJK).

Menara MTH, 18th Floor

Jl. M.T Haryono Kav. 23,

Jakarta 12820 Indonesia

+6221-8378 2364

info@paques.id

Copyrights © 2021 All Rights Reserved by PT Informatika Solusi Bisnis